- Defence budget increased from existing Rs 776 billion rupees to Rs 860 billion

- 10pc adhoc relief on running basic pay with merger of 2013-2014 increases in pay

Highlights of 2016-17 budget

Following are the highlights of the federal budget for 2016-17.

– Economic Growth 4.71%, highest in past eight years

– Per Capita income up to $1,561, growth of 17%

– Inflation 2.82%; lowest in a decade

– FBR Revenue target of Rs 3104 to be achieved; 60% increase in three years

– Fiscal Deficit down to 4.3% in 2015 16

– Exports declined by 11% recorded at $18.2 billion

– Imports at $32.7 billion; savings from oil import around 40%; diverted to increased import of machinery.

– Cumulative growth of 40% in machinery over last three years.

– Remittances were $16 billion in 2015 16; target for 2016 17 $19 bln

– Exchange Rate stable at Rs 104.70 per dollar

– Foreign Exchange Reserves increased to historic $21.6 billion

– Current Account Deficit maintained at 1% of GDP over three years.

ISLAMABAD, June 3: A relief loaded and growth oriented federal budget for the next financial year has been announced with a total outlay of 4395 billion rupees.

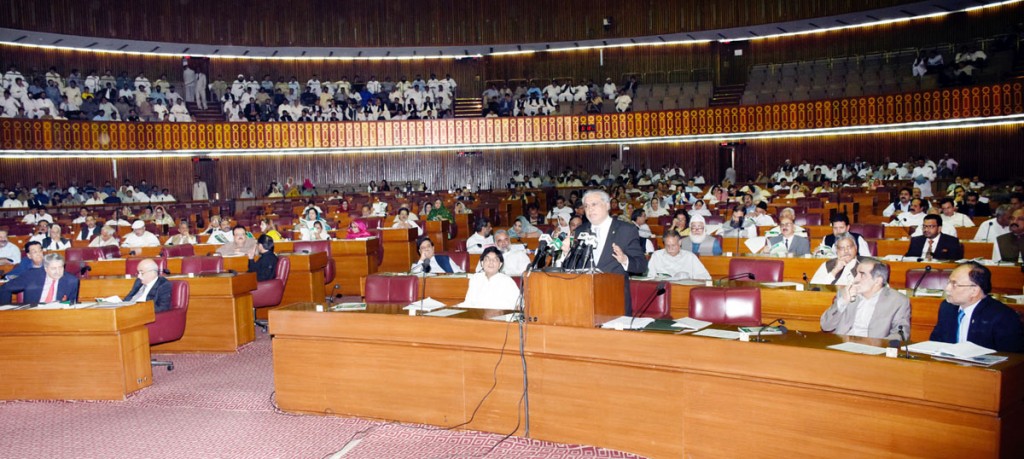

Presenting budgetary proposals in the National Assembly on Friday evening, Finance Minister Ishaq Dar described it a historic day for agriculture sector as the budget envisages extensive relief and incentives for farmers.

He said gross revenue receipts of the federal government for next financial year are estimated at 4915 billion rupees compared to revised figures of 4332 billion for outgoing year, showing an increase of thirteen point five percent. He said we have set an ambitious target for the tax collection which is a prerequisite to increase development spendings.

The share of provincial governments out of these taxes will be 2136 billion rupees compared to 1852 billion for outgoing year, showing an increase of about fifteen point three percent. He said the net resources left with the federal government will be 2781 billion compared to revised estimates of 2481 billion rupees for outgoing year.

The current expenditure is estimated at 3400 billion rupees for next year against revised estimate of 3282 billion rupees for current financial year.

The defense budget is being increased from existing 776 billion rupees to 860 billion rupees for the next year, showing an increase of about eleven percent.

The Finance Minister explaining budget strategy for the next financial year in the National Assembly said fiscal deficit would be brought down from the existing 4.3 to 3.8% next year.

He said there would be continued focus on energy sector and more than 10,000 MW of additional electricity would be added to the national grid by March 2018. After 2018, work would continue on several projects including Dassu, Diamer Bhasha dam and projects under CPEC to generate 21500 MW of electricity.

The Finance Minister announced an increase in allocations for Benazir Income Support Programme from the existing 102 billion rupees to 115 billion rupees for the next financial year.

He said 5.3 million families would be benefitting from the programme by the close of the current financial year and the number of these families would increase to 5.6 million during next year.

He said allocations for Pakistan Baitul Mal have been doubled to four billion rupees.

Enumerating the salient features of media term micro framework 2016-19, the Finance Minister said that GDP growth rate will be enhanced to seven percent in the next three years.

He said inflation rate will be kept at single digit while investment to GDP ratio will be enhanced to 21 percent. He said that fiscal deficit will be brought down to 3.5 percent while tax to GDP ratio will be enhanced to 14 percent.

Ishaq Dar said that foreign exchange reserves will be pushed up thirty billion dollars. He said given the economic performance last three years, this micro-economic framework is very much implementable.

He said that the government has also chalked out a comprehensive plan to encourage private investment in different sectors including transport and infrastructure. He said similarly, foreign direct investment will be facilitated which will help enhance the economic activity in the country. He said our plan also envisages establishment special economic zones which will create job opportunities for youths.

Ishaq Dar said promotion of health and education as well as poverty alleviation and women empowerment are the main targets of the Public Sector Development Programme. He said the government is also giving priority to the construction of Small dams especially in Balochistan and Khyber Pakhtunkhwa province.

The Finance Minister also announced a series of measures for the provision of telecommunication and internet facilities in the far flung areas of the country.

The Finance Minister announced tax relief and growth measures for different sectors of the economy.

He announced ten percent adhoc relief allowance on running basic pay to all federal government employees with effect from first of next month. Adhoc increases of 2013 and 2014 will be merged in the pay scales.

There will be ten percent increase in net pension to all pensioners of federal government. Twenty-five percent increase in net pension to all pensioners of federal government above eighty-five years of age will be given.

Special area compensatory allowance at the uniform rate of three hundred per month will be given to civil armed forces posted in border areas while special conveyance allowance to disabled employees would be given at the rate of one thousand rupees per month.

There is also an increase in integrated allowance to naib qasids and daftaries, revision of outfit allowance to Pak army officers, revision of late sitting conveyance charges, washing allowance , M.Phil allowance, additional charge allowance and current charge special pay.

The Finance Minister announced upgradation of the post of LDC from basic scale seven to nine; UDC from nine to eleven; assistant from 14 to 16 and assistant incharge from BS-15 to 16. Posts of Khateebs have been upgraded from BS-12 to fifteen, Moazzan from 5 to seven and Khadim BS-5 to 6.

On the pattern of increase in the pay of government employees, the minimum wage of labour has also been increased from 13000 to 14000 per month.

The Finance Minister said the government would be spending additional 57 billion rupees on account of pay and pensions relief.

He announced a special package for development of agriculture sector. It envisages continuation of tax and duty concessions announced in the last budget amounting to 15 billion rupees to promote agriculture sector development.

He said the government has decided that the price of urea would be further reduced to 1400 rupees per bag for which federal and provincial governments will share a subsidy of 36 billion rupees. Similarly the government has decided that the price per bag of DAP will be 2500 rupees from 1st of next month. Federal and provincial governments will be sharing a subsidy of ten billion rupees on this account.

Ishaq Dar said the volume of agriculture credit is being increased from the existing 600 billion to 700 billion for next year.

The government has developed a framework to reduce mark up rates of ZTBL, National Bank, Bank of Punjab and Punjab Cooperative by two percent. From first of next month current rate of off peak rate of 8.85 rupees per unit for agriculture tube wells is being reduced to 5.35 rupees per unit for which the government will bear expenses of 27 billion rupees.

The Finance Minister also announced concession of customs duty for dairy, livestock and poultry sectors as well as fish farming. The existing seven percent sale tax on pesticides is being proposed to be abolished.

Concessions for industrial development include enhancing tax credit on employment generation and tax credit for making sales to registered persons; balancing modernization and replacement of plant and machinery; establishing new industry and expansion of existing plant or new project.

The budget envisages reduction of customs duty on import of parts of LED lights from existing twenty percent to five percent.

In order to further enhance the export competitiveness of textile sector, the new budget envisages extension of the existing scheme on drawback of local taxes for the next year. Technology upgradation fund scheme for the textile sector has been formulated to benefit SMEs to invest in new technologies to make Pakistan’s exports globally competitive.

The mark up rates on export refinance facility, which was nine point five percent in June 2013 will be brought down to three percent from first of next month.

Textile, leather, sports goods, surgical goods and carpets would be made part of zero rated tax regime from next year. -NNI